Impact of the US Election on USD

January 26, 2021 @ 18:07 +03:00

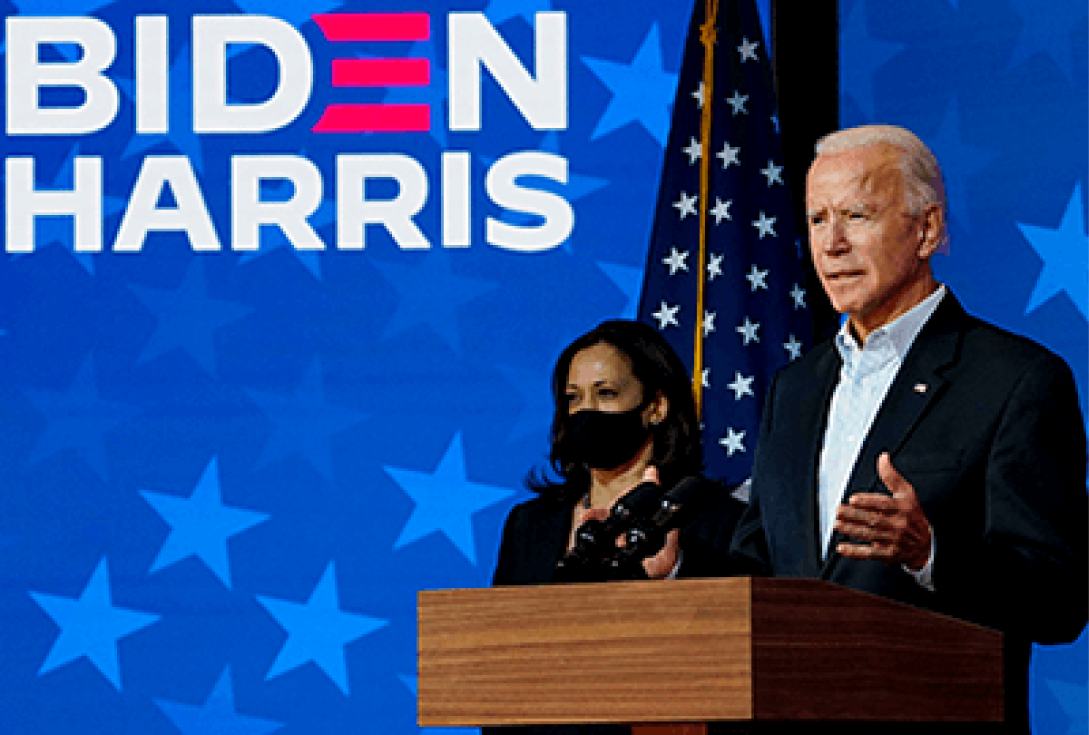

Multiple financial instruments such as equities, futures and forex show great interest in how strong the United States dollar is. This strength will determine the economy’s health on the whole. The US Presidential Election greatly affects the domestic economy, and its potential impact on the US dollar itself can be significant.

The US Election has brought a great deal of uncertainty around the US dollar and could greatly affect it. However, history suggests that the US dollar generally rises irrespective of the winner. In fact, nine out of the 10 elections since 1980 showed that the USD has become stronger in the first 100 days of the presidency. Somewhat surprisingly, following a Democratic victory , the US dollar has historically risen by 4%, compared to 2% when a Republican candidate prevailed.

US Before the Election

Several factors have consistently placed pressure on the dollar, in a negative way. The Federal Reserve’s ongoing commitment to near-zero interest rates is one of the factors behind this. Moreover, the rising debt-to-GDP ratio, and the continuous harmful influence of Covid-19 on the economy are some other reasons.

Nevertheless, while earlier stimulus has been undermined, the dollar and Trump’s recent call to stop any new Covid-19 negotiations, meant that USD could become stronger in response.

Specifically, because of the failure to produce an early election result, the pound slumped 0.5 per cent against the dollar a few days prior. At midnight, the pound was trading at $1.315 but fell to $1.290, before settling at around $1.300. A day before the election, markets had moved in favour of Joe Biden, with the US dollar falling on expectations of increased fiscal stimulus. The dollar also gained ground against other currencies, as investors looked for safer paths during periods of uncertainty. The Dow Jones was also up by 2.2 per cent.

How are companies affected?

Following the pattern of history, the dollar will strengthen in the next three and a half months. However, due to the significant mail-in factor from then election and the unclarity of the result for the first few days, there was increased volatility for the dollar between November 3 and when the winner was eventually announced.

The dollar could prove to be considerably profitable with Biden. Trump would not accept defeat like his predecessors, so the Republic would fall into an unwanted situation, resulting in a political crisis, which would bring even greater volatility for the US dollar.

Companies should be prepared for a volatile period regarding the U.S. dollar, but they also need to bear in mind the history behind it, as mentioned above. Regardless of a Democrat or Republican winner, the USD will eventually strengthen. Currently however, in the short-term, long-term, , and based on the wide range of factors affecting the currency, the USD will probably experience a prolonged period of fragility compared to its successful development of recent years.